The Basic Principles Of Pvm Accounting

The Basic Principles Of Pvm Accounting

Blog Article

The Of Pvm Accounting

Table of ContentsPvm Accounting - QuestionsThe Definitive Guide for Pvm AccountingThe Best Guide To Pvm AccountingPvm Accounting Can Be Fun For Everyone9 Simple Techniques For Pvm AccountingThe 3-Minute Rule for Pvm Accounting

Look after and take care of the production and authorization of all project-related payments to consumers to cultivate excellent interaction and avoid problems. Clean-up accounting. Make certain that proper reports and documentation are submitted to and are updated with the internal revenue service. Make sure that the bookkeeping process follows the regulation. Apply needed construction bookkeeping standards and treatments to the recording and reporting of building and construction activity.Connect with various funding firms (i.e. Title Company, Escrow Company) concerning the pay application procedure and requirements needed for settlement. Assist with carrying out and keeping internal financial controls and procedures.

The above declarations are intended to describe the general nature and level of job being executed by people assigned to this classification. They are not to be taken as an extensive list of obligations, responsibilities, and abilities required. Personnel may be needed to execute duties outside of their typical obligations every so often, as required.

Pvm Accounting Can Be Fun For Anyone

Accel is seeking a Construction Accounting professional for the Chicago Workplace. The Building and construction Accountant does a range of accountancy, insurance conformity, and job administration.

Principal duties consist of, however are not restricted to, managing all accounting functions of the company in a prompt and accurate fashion and offering records and routines to the company's certified public accountant Firm in the prep work of all financial declarations. Guarantees that all audit procedures and functions are handled accurately. Liable for all financial documents, payroll, financial and daily procedure of the accounting function.

Prepares bi-weekly trial balance records. Functions with Task Managers to prepare and publish all regular monthly billings. Processes and problems all accounts payable and subcontractor settlements. Generates monthly recaps for Employees Payment and General Obligation insurance policy premiums. Generates month-to-month Task Price to Date records and collaborating with PMs to reconcile with Project Managers' allocate each job.

Getting The Pvm Accounting To Work

Efficiency in Sage 300 Building And Construction and Realty (previously Sage Timberline Office) and Procore building and construction monitoring software application an and also. https://www.mixcloud.com/pvmaccount1ng/. Should likewise be efficient in other computer software systems for the prep work of reports, spreadsheets and other audit evaluation that may be called for by monitoring. construction taxes. Should possess solid organizational abilities and ability to focus on

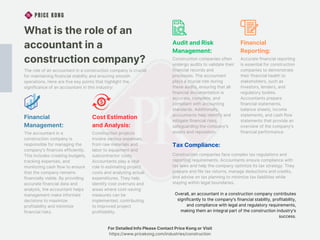

They are the monetary custodians who ensure that building and construction jobs stay on budget, abide with tax obligation policies, and keep monetary transparency. Building and construction accountants are not simply number crunchers; they are tactical companions in the building process. Their main duty is to handle the monetary aspects of building tasks, making sure that sources are designated efficiently and economic risks are lessened.

Pvm Accounting - Questions

By preserving a limited hold on job financial resources, accountants aid prevent overspending and financial setbacks. Budgeting is a foundation of effective construction tasks, and building and construction accounting professionals are crucial in this respect.

Building accountants are well-versed in these laws and make sure that the project abides with all tax needs. To excel in the role of a construction accounting professional, individuals require a solid instructional foundation in accountancy and finance.

Furthermore, qualifications such as Qualified Public Accountant (CPA) or Qualified Construction Industry Financial Expert (CCIFP) are extremely related to in the sector. Building projects usually involve tight deadlines, altering regulations, and unanticipated expenditures.

Indicators on Pvm Accounting You Need To Know

Professional accreditations like certified public accountant or important link CCIFP are also highly suggested to show experience in building and construction accounting. Ans: Building accounting professionals create and keep track of budget plans, recognizing cost-saving possibilities and ensuring that the task remains within budget. They also track expenses and forecast financial needs to stop overspending. Ans: Yes, construction accounting professionals take care of tax obligation conformity for building and construction tasks.

Intro to Building And Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business have to make difficult choices amongst several monetary options, like bidding on one project over another, picking funding for materials or tools, or establishing a job's profit margin. Construction is an infamously unstable sector with a high failure price, slow time to settlement, and irregular cash circulation.

Normal manufacturerConstruction organization Process-based. Manufacturing involves duplicated procedures with easily recognizable expenses. Project-based. Production needs different processes, materials, and tools with differing expenses. Taken care of area. Production or manufacturing takes place in a single (or several) regulated locations. Decentralized. Each project takes place in a brand-new area with varying website problems and one-of-a-kind obstacles.

The 2-Minute Rule for Pvm Accounting

Lasting relationships with vendors reduce settlements and improve effectiveness. Irregular. Regular use different specialty service providers and distributors influences performance and capital. No retainage. Payment shows up in complete or with regular settlements for the full contract quantity. Retainage. Some portion of settlement may be kept till project completion even when the service provider's job is finished.

Regular production and short-term contracts result in workable capital cycles. Uneven. Retainage, slow payments, and high upfront costs lead to long, irregular cash money circulation cycles - construction taxes. While standard suppliers have the benefit of regulated environments and optimized manufacturing procedures, building and construction firms have to constantly adapt per brand-new task. Also somewhat repeatable projects require alterations as a result of website conditions and other variables.

Report this page